With auto loan refinancing options 2025 at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

As we delve into the landscape of auto loan refinancing, exploring the predicted trends and factors influencing the future by 2025, we uncover a world of possibilities and changes that await.

Auto Loan Refinancing Options 2025

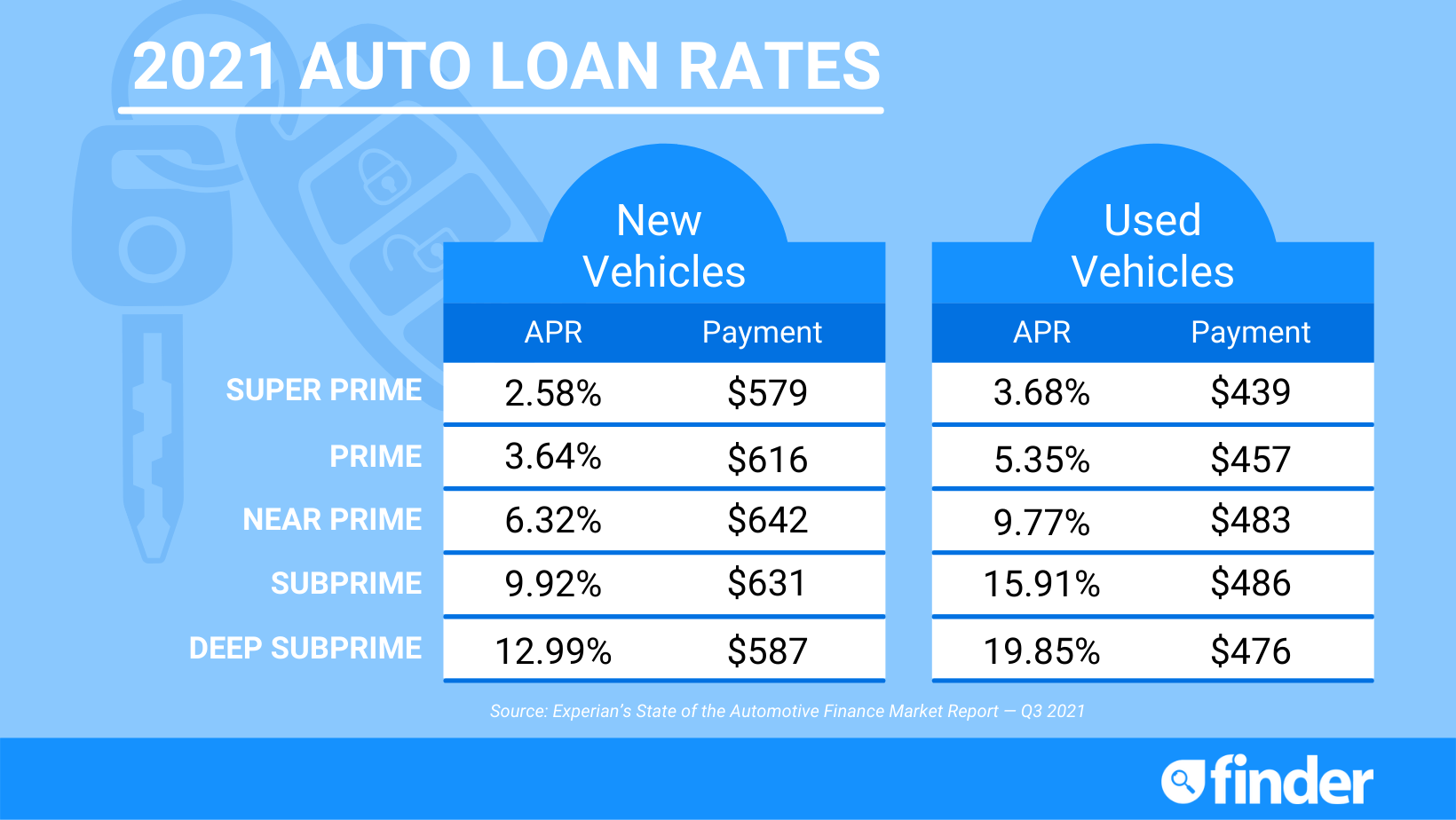

In the landscape of auto loan refinancing, borrowers have the opportunity to potentially lower their monthly payments, reduce interest rates, or even shorten the loan term. Auto loan refinancing involves replacing an existing loan with a new one, typically with better terms. This process can help borrowers save money over time and better manage their finances.

Predicted Trends in Auto Loan Refinancing by 2025

- Increased digitalization: With advancements in technology, the auto loan refinancing process is expected to become more streamlined and accessible online. Borrowers may be able to complete the entire refinancing process from the comfort of their homes.

- Personalized loan options: Lenders are likely to offer more personalized refinancing options based on individual credit profiles and financial situations. This could lead to better rates and terms for borrowers.

- Growth in competition: As the demand for auto loan refinancing continues to rise, more lenders may enter the market, leading to increased competition. Borrowers could benefit from a wider range of refinancing options to choose from.

Factors Influencing the Future of Auto Loan Refinancing Options

- Economic conditions: The state of the economy, including interest rates and inflation, can impact the availability of favorable refinancing terms. Changes in economic conditions may influence borrowers’ decisions to refinance their auto loans.

- Regulatory environment: Government regulations and policies related to lending practices can affect the refinancing landscape. Changes in regulations may influence how lenders structure their refinancing offers.

- Consumer behavior: Shifts in consumer preferences and behaviors, such as a greater emphasis on financial literacy and awareness, can drive changes in the auto loan refinancing market. Borrowers’ understanding of the benefits of refinancing may play a significant role in shaping future options.

Technological Advancements in Auto Loan Refinancing

Technology is revolutionizing the way auto loan refinancing is done, offering more convenience, efficiency, and personalized options for consumers. With the integration of AI and automation, the refinancing process has become faster and more accurate, providing borrowers with better rates and terms tailored to their specific financial situations.

Impact of AI and Automation

AI and automation have significantly streamlined the auto loan refinancing process by analyzing vast amounts of data in real-time. This enables lenders to make quicker decisions on loan approvals and offer more competitive rates to borrowers. By utilizing algorithms and machine learning, AI can also assess a borrower’s creditworthiness more effectively, leading to more accurate risk assessment and personalized loan offers.

Potential Innovations by 2025

By 2025, we can expect to see further innovations in auto loan refinancing, such as the widespread adoption of blockchain technology for secure and transparent transactions. Additionally, the rise of mobile apps and digital platforms will make it easier for borrowers to compare offers, submit applications, and track the status of their refinancing process in real-time. Virtual reality might also play a role in providing virtual showroom experiences for borrowers to explore different loan options and terms visually.

Customer Experience and Personalization

Customer experience plays a crucial role in auto loan refinancing, as it directly impacts customer satisfaction and loyalty. Lenders need to focus on providing a seamless and personalized experience to attract and retain customers in a competitive market.

Importance of Customer Experience

Customer experience in auto loan refinancing is vital as it influences the overall perception of the lender and the likelihood of repeat business. A positive experience can lead to increased customer loyalty, word-of-mouth referrals, and higher customer lifetime value.

- Streamlined application process

- Prompt and clear communication

- Transparent terms and conditions

- Responsive customer support

Personalization of Refinancing Options

Lenders can personalize refinancing options for customers by leveraging data analytics and customer insights to tailor loan terms, interest rates, and repayment schedules to individual needs and preferences. Personalized offers can increase customer engagement and conversion rates.

By analyzing customer data and behavior, lenders can create targeted refinancing offers that meet specific customer needs and financial goals.

Role of Digital Platforms

Digital platforms play a key role in enhancing the customer experience in auto loan refinancing by providing convenient access to information, online application processes, and real-time account management. These platforms enable customers to compare offers, track their refinancing progress, and receive personalized recommendations based on their financial profile.

- Online loan calculators

- Mobile-friendly interfaces

- Personalized dashboard for each customer

- 24/7 access to account information

Regulatory Changes and Compliance

In the auto loan refinancing industry, regulatory changes play a crucial role in shaping the landscape and influencing the options available to consumers. By 2025, anticipated regulatory changes are expected to have a significant impact on how refinancing is conducted and what compliance requirements need to be met by lenders and borrowers.

Impact of Regulatory Changes

- Increased Transparency: Regulatory changes may focus on enhancing transparency in the auto loan refinancing process, ensuring that borrowers are fully informed about the terms and conditions of their refinanced loans.

- Consumer Protection: Anticipated changes may also prioritize consumer protection, with regulations aimed at preventing predatory lending practices and ensuring fair treatment for all borrowers.

- Digital Compliance: As technological advancements continue to shape the industry, regulatory changes may emphasize the need for lenders to comply with digital security and data protection measures to safeguard consumer information.

Last Recap

Exploring the realms of technology, customer experience, regulatory changes, and compliance in the context of auto loan refinancing options 2025 paints a vivid picture of the evolving industry and the opportunities it holds for borrowers and lenders alike.