Bad credit home loans lenders near me sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. Understanding the ins and outs of finding the right lender in your local area is crucial for your home loan journey.

Researching local lenders, comparing loan options, and meeting with lenders are key steps in securing a bad credit home loan, and we will explore these aspects in depth.

Understanding Bad Credit Home Loans Lenders

Bad credit home loans lenders are financial institutions or private lenders that provide home loans specifically tailored for individuals with poor credit scores. These lenders specialize in working with borrowers who may have a history of late payments, defaults, or other negative marks on their credit reports.

Criteria for Being Considered a Bad Credit Borrower

Individuals are typically classified as bad credit borrowers if they have a credit score below a certain threshold, often around 580 or lower. Factors such as high debt-to-income ratio, previous foreclosures or bankruptcies, and a limited credit history can also contribute to being considered a bad credit borrower.

Importance of Finding Local Lenders in Your Area

Working with local bad credit home loans lenders in your area can offer several advantages. Local lenders may have a better understanding of the local housing market and can provide more personalized service. Additionally, meeting face-to-face with a lender can help build trust and facilitate communication throughout the loan application process.

Researching Local Lenders Near Me

When looking for bad credit home loans lenders in your area, it’s important to consider the following tips to help you find the right fit for your needs.

Benefits of Working with Local Lenders

- Personalized Service: Local lenders often provide more personalized service and can tailor loan options to fit your specific financial situation.

- Faster Processing: Working with local lenders can lead to quicker loan processing times, as you can meet face-to-face and discuss your needs in detail.

- Local Market Knowledge: Local lenders have a better understanding of the local housing market, which can be beneficial when navigating the home buying process.

Potential Drawbacks of Using Online Lenders versus Local Ones

- Lack of Personalization: Online lenders may not offer the same level of personalized service as local lenders, as communication is often done remotely.

- Longer Response Times: Online lenders may have longer response times compared to local lenders, which can delay the loan approval process.

- Limited Understanding of Local Market: Online lenders may not have the same insight into the local housing market as local lenders, potentially leading to less favorable loan terms.

Comparing Loan Options

When looking for bad credit home loans, it’s essential to compare the different options available to find the best fit for your financial situation. Here, we will discuss the various types of bad credit home loans, compare interest rates offered by different lenders, and explain how credit scores can impact loan terms and conditions.

Types of Bad Credit Home Loans

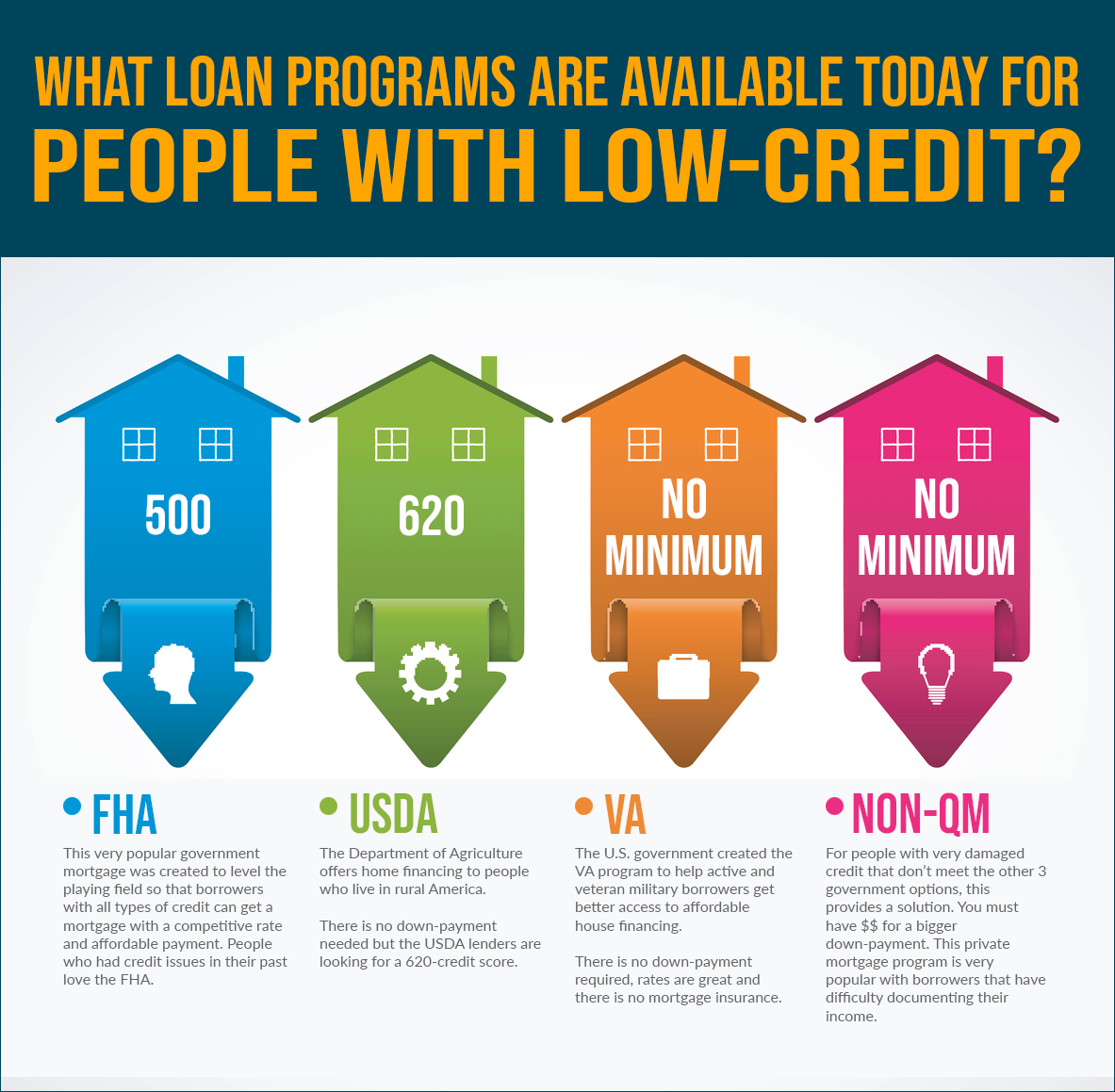

- FHA Loans: These are government-backed loans that are accessible to borrowers with lower credit scores.

- VA Loans: Available to veterans and active-duty service members, these loans often have more flexible credit requirements.

- Subprime Loans: These loans are specifically designed for borrowers with poor credit scores, but they typically come with higher interest rates.

Comparing Interest Rates

- It’s important to shop around and compare interest rates offered by various lenders to ensure you’re getting the best deal.

- Higher credit scores generally result in lower interest rates, so improving your credit score can help you secure a more favorable loan.

- Consider factors like the term of the loan, adjustable vs. fixed rates, and any additional fees when comparing interest rates.

Impact of Credit Scores

- A lower credit score can result in higher interest rates and less favorable loan terms.

- Lenders may require a larger down payment or charge higher fees for borrowers with poor credit scores.

- Improving your credit score over time can help you qualify for better loan options and save money on interest payments.

Meeting with Lenders

When it comes to meeting with bad credit home loans lenders, it is important to be prepared and organized. This meeting will be crucial in determining your eligibility for a loan and discussing the options available to you.

Setting up Appointments

Setting up appointments with bad credit home loans lenders can be done through phone calls, emails, or online forms. It is important to schedule these meetings at a time that is convenient for both parties. Be prepared to provide information about your financial situation and credit history.

Checklist of Documents

- Proof of income (pay stubs, tax returns)

- Bank statements

- Proof of identity (driver’s license, passport)

- Credit report

- List of assets and liabilities

Having these documents ready will help streamline the process and show the lender that you are serious about obtaining a loan.

Importance of Asking Questions

During the initial consultation with bad credit home loans lenders, it is important to ask questions to clarify any doubts and understand the terms of the loan. Some questions you may want to ask include:

- What are the interest rates and fees associated with the loan?

- What is the repayment schedule like?

- Are there any penalties for early repayment?

- What are the eligibility requirements for this loan?

Asking these questions will help you make an informed decision and ensure that you are comfortable with the terms of the loan.

Summary

In conclusion, navigating the realm of bad credit home loans lenders near me requires careful consideration and understanding of your options. By following the tips and insights provided, you can make informed decisions on your home loan journey.