Starting with quick business line of credit approval, this overview sets the stage for businesses seeking immediate financial solutions.

Understanding the essence of business credit lines and the pivotal role of speedy approval is crucial for entrepreneurs navigating the financial landscape.

Understanding Quick Business Line of Credit Approval

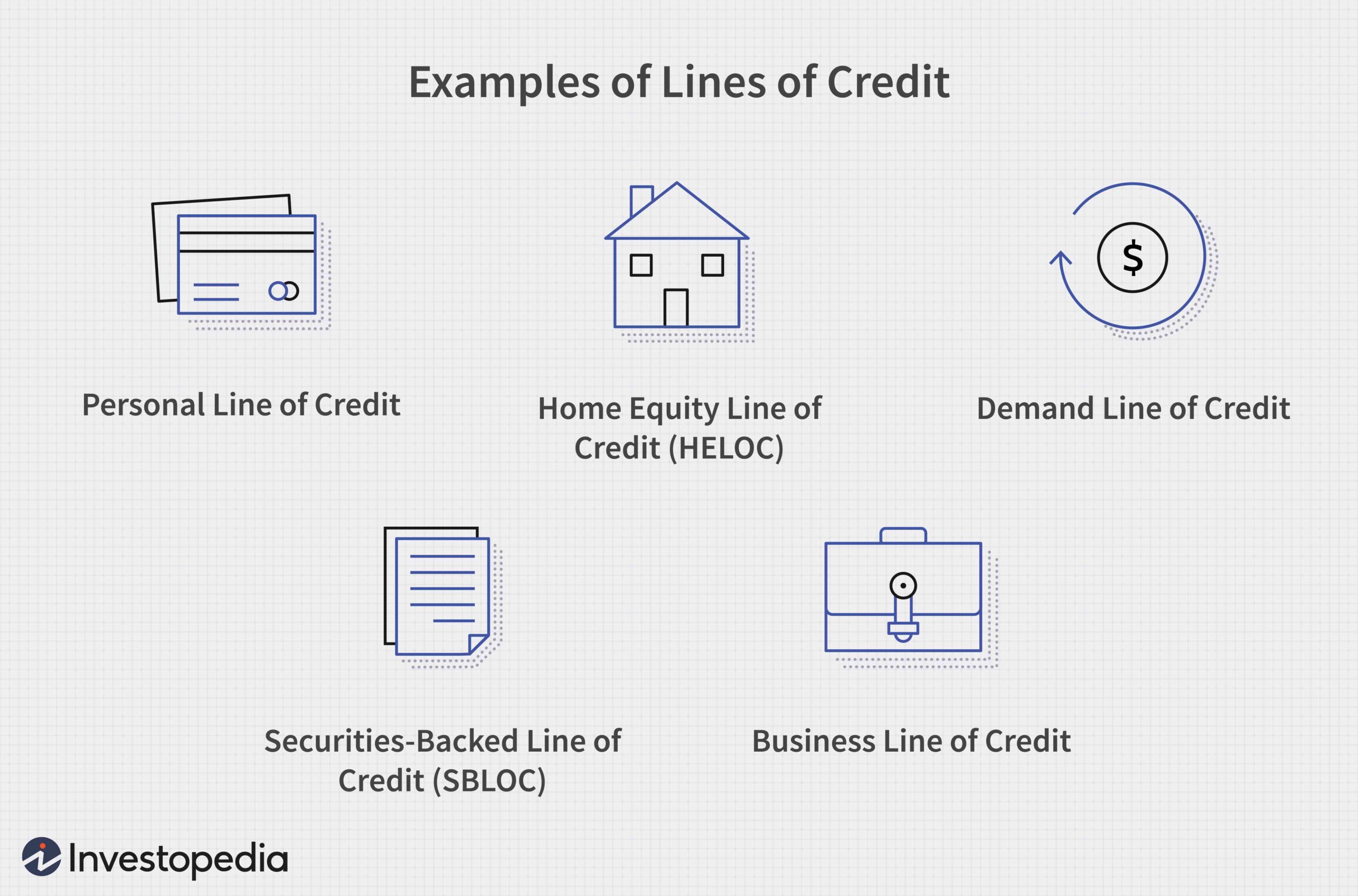

A business line of credit is a flexible financial tool that allows businesses to access funds up to a predetermined limit. It differs from traditional loans in that businesses can withdraw funds as needed, repay, and then withdraw again, similar to a credit card. Quick approval for a business line of credit is crucial for companies facing immediate financial needs, such as covering payroll, purchasing inventory, or seizing growth opportunities.

Significance of Quick Approval

Obtaining quick approval for a business line of credit can make a significant difference for a company’s operations. It enables businesses to address urgent financial needs promptly without disrupting their day-to-day activities. Quick access to funds can help companies seize time-sensitive opportunities, manage cash flow fluctuations, and navigate unexpected expenses efficiently.

Key Factors Influencing Approval Speed

- Strong Credit History: A solid credit history demonstrates financial responsibility and can expedite the approval process for a business line of credit.

- Financial Documents: Providing accurate and up-to-date financial documents, such as tax returns and bank statements, can speed up the approval process by showcasing the company’s financial health.

- Business Performance: Lenders may consider factors like revenue growth, profitability, and business stability when evaluating a business line of credit application. Positive performance indicators can increase the likelihood of quick approval.

- Relationship with Lender: Existing relationships with lenders or financial institutions can play a role in expediting the approval process. Companies with a history of responsible borrowing and timely repayments may receive faster approval for a business line of credit.

Eligibility Criteria for Quick Approval

To be eligible for quick approval of a business line of credit, there are certain common requirements that businesses need to meet. Additionally, maintaining a good credit score plays a crucial role in securing fast approval. Here are some tips on how businesses can improve their eligibility for a line of credit:

Common Eligibility Requirements

- Stable Business Revenue: Lenders often look for businesses with a steady stream of revenue to ensure repayment.

- Time in Business: Typically, lenders prefer businesses that have been operating for a certain period, usually at least one year.

- Good Credit Score: A strong credit score is essential for quick approval, as it reflects the business’s creditworthiness.

- Low Debt-to-Income Ratio: Lenders assess the debt-to-income ratio to determine the business’s ability to take on additional debt.

Tips for Improving Eligibility

- Monitor and Improve Credit Score: Regularly check credit reports for errors and work on improving the credit score by making timely payments.

- Reduce Debt: Lowering existing debt levels can positively impact the debt-to-income ratio, making the business more attractive to lenders.

- Maintain Detailed Financial Records: Keeping accurate financial records showcases the business’s stability and helps in the approval process.

- Establish a Relationship with the Bank: Building a strong relationship with the bank can increase the chances of quick approval for a line of credit.

Importance of a Good Credit Score

Maintaining a good credit score is crucial for obtaining quick approval for a business line of credit. A good credit score demonstrates the business’s ability to manage finances responsibly and repay debts promptly. Lenders use credit scores as a key factor in assessing the risk associated with lending to a business. Therefore, businesses should prioritize maintaining a healthy credit score to enhance their eligibility for quick approval of a line of credit.

Application Process for Quick Business Line of Credit Approval

When applying for a business line of credit, it is essential to follow a structured process to ensure a smooth and timely approval. Streamlining the application process can help expedite the approval and provide your business with the necessary financial flexibility. Here are the typical steps involved in applying for a business line of credit and how to make the process faster:

Step 1: Research and Choose the Right Lender

- Research different lenders offering business lines of credit and compare their terms, interest rates, and requirements.

- Choose a lender that best suits your business needs and has a quick approval process.

Step 2: Gather Required Documentation

- Prepare all necessary documentation, including financial statements, tax returns, business plan, and any other relevant information requested by the lender.

- Having all the required documents ready can speed up the application process and increase the chances of approval.

Step 3: Complete the Application Form

- Fill out the application form accurately and provide all the requested information without any missing details.

- Double-check the form to ensure all fields are completed correctly to avoid delays in processing.

Step 4: Submit the Application

- Submit the completed application form along with the required documentation to the lender through their preferred method (online, in-person, or via email).

- Ensure timely submission to initiate the review process promptly.

Step 5: Follow Up and Provide Additional Information

- Stay in touch with the lender and be responsive to any additional information or documentation they may request during the review process.

- Promptly provide any supplementary details to expedite the approval decision.

Step 6: Await Approval Decision

- Once the application is submitted, wait for the lender to review the information and make a decision regarding the approval of the business line of credit.

- Be prepared to accept the terms and conditions of the credit line upon approval.

Alternative Options for Quick Business Funding

When seeking quick funding for your business, there are several alternatives to business lines of credit that you can explore. Each option comes with its own set of pros and cons, so it’s important to understand which one aligns best with your business needs.

Business Cash Advance

A business cash advance allows you to receive a lump sum payment upfront, which you will repay with a percentage of your daily credit card sales. This option can be a quick way to access funds, especially if you have consistent credit card sales. However, the repayment terms can sometimes be more expensive compared to traditional loans.

Invoice Financing

Invoice financing involves selling your unpaid invoices to a lender at a discount in exchange for immediate cash. This can be beneficial if you have outstanding invoices and need quick access to funds. Keep in mind that the discount on the invoices can eat into your profits.

Merchant Cash Advance

Similar to a business cash advance, a merchant cash advance provides you with a lump sum payment that is repaid through a percentage of your daily credit card sales. While this option can be convenient for businesses with fluctuating sales, the repayment terms can be costly.

Equipment Financing

If you need funds to purchase equipment for your business, equipment financing can be a viable option. This involves borrowing money to buy equipment, with the equipment itself serving as collateral. While this can be a good way to acquire necessary assets, keep in mind that you may be limited to using the funds for equipment purchases only.

Small Business Administration (SBA) Loans

SBA loans are government-backed loans that offer competitive terms and rates for small businesses. While the application process can be more extensive compared to other quick funding options, SBA loans can provide substantial funding with favorable terms for eligible businesses.

Final Thoughts

In conclusion, the journey towards securing quick business line of credit approval is paved with insights on eligibility, application processes, and alternative funding avenues.